In Nigeria, the rise of loan apps has changed the way many people manage their finances. With so many options available, it can be overwhelming to choose the right one. In this blog, let’s share some insights on the top loan apps in Nigeria, highlighting their unique features and what you need to consider before borrowing.

Introduction to Loan Apps in Nigeria

Loan apps in Nigeria have become essential tools for many people seeking quick financial relief. They offer a convenient way to access funds without the long processes associated with traditional banks. But with so many options available, it’s crucial to understand what these apps are and how they work.

The Growing Popularity of Loan Apps

Since the lockdown in 2020, more Nigerians have turned to loan apps for financial support. The ease of access and the speed at which funds are disbursed make them attractive. Many people rely on these apps to cover unexpected expenses or to bridge financial gaps.

However, the increase in demand has also led to a rise in the number of loan apps available. This can make it challenging to choose the right one. With the right information, you can make informed decisions and avoid potential pitfalls.

Finding the Right Loan App

Finding the right loan app is essential for a positive borrowing experience. Not all loan apps are created equal. Some offer better terms, lower interest rates, and more reliable customer service than others. Here are some tips to help you find the best loan app for your needs:

- Research: Look for reviews and ratings from other users. This will give you insight into their experiences.

- Check Interest Rates: Compare interest rates among different loan apps to find the most affordable option.

- Understand Terms and Conditions: Read the fine print to know what you’re signing up for.

- Customer Service: Ensure the app has a reliable customer service system in place for any issues that may arise.

Key Factors to Consider

When choosing a loan app, consider the following key factors:

- Loan Amount: Determine how much you need to borrow. Different apps have different maximum and minimum loan amounts.

- Repayment Terms: Understand the repayment period and if there are options to extend your loan if necessary.

- Fees: Look out for hidden fees, such as late payment charges or processing fees.

- Security: Ensure the app is secure and has measures in place to protect your personal information.

How to Borrow from Loan Apps

Borrowing from loan apps is usually a straightforward process. Here’s a typical step-by-step guide on how to borrow:

- Download the App: Start by downloading the loan app from the Google Play Store or Apple App Store.

- Create an Account: Sign up by providing your personal information, including your Bank Verification Number (BVN).

- Submit Your Application: Enter the amount you wish to borrow and submit your application for review.

- Receive Approval: Wait for the app to process your application. If approved, you will receive a notification.

- Access Your Funds: Once approved, the funds will be disbursed to your bank account.

Branch: A Top Contender

Branch is one of the most popular loan apps in Nigeria, known for its competitive interest rates and user-friendly interface. Here are some features that make Branch stand out:

- Low Interest Rates: Branch offers one of the lowest interest rates, typically around 20%.

- No Late Payment Fees: Unlike many other loan apps, Branch does not charge late payment fees, which can help borrowers avoid unnecessary costs.

- Flexible Repayment Options: The app provides options for easy repayment, making it convenient for users.

However, it’s important to remember that missing a payment could affect your ability to borrow again in the future. Always ensure you can meet your repayment obligations before borrowing.

Carbon: More than Just a Loan App

Carbon is more than just a loan app; it’s like having a bank in your pocket. With an interest rate of just 15%, Carbon stands out for its versatility. It offers users a chance to open a bank account, get a debit card, and even invest their money. This app is designed to cater to a wide range of financial needs.

One of the best features of Carbon is its user-friendly interface. You can easily navigate through the app to access different services. Whether you want to borrow, save, or invest, everything is done seamlessly. It’s not just about borrowing money; it’s about managing your finances effectively.

However, be cautious. While Carbon is a great app, it’s crucial to read the terms carefully. Understanding the repayment schedule and any potential fees will save you from future headaches.

Palmcredit: A Double-Edged Sword

Palmcredit is a loan app that seems appealing at first glance. They often offer higher loan amounts compared to others, which can be tempting. For instance, your first loan might start at 9,000 Naira, but as you continue to borrow, the amounts can skyrocket. However, this app has its pitfalls.

Many users have reported that the interest rates can be as high as 24%, especially for larger loans. What starts as a simple borrowing experience can quickly turn into a financial trap. The longer repayment terms can also lead to increased interest, making it challenging to pay back the loan without incurring hefty fees.

So, while Palmcredit may offer generous initial loans, always remember to consider the long-term implications before borrowing.

L-Credit: The Risks Involved

L-Credit is another loan app that has gained popularity, but it comes with significant risks. While it offers quick loans, the interest rates can be steep, reaching up to 21%. This can quickly add up, especially if you miss a payment.

One of the alarming features of L-Credit is its aggressive collection methods. If you fail to pay on time, they may contact your phone contacts. This can cause embarrassment and stress, making the borrowing experience even more challenging.

Despite these risks, L-Credit does provide a straightforward application process. Just like other loan apps, you’ll need to provide your BVN and other personal details. But remember, the convenience of borrowing should not overshadow the potential consequences of failing to repay.

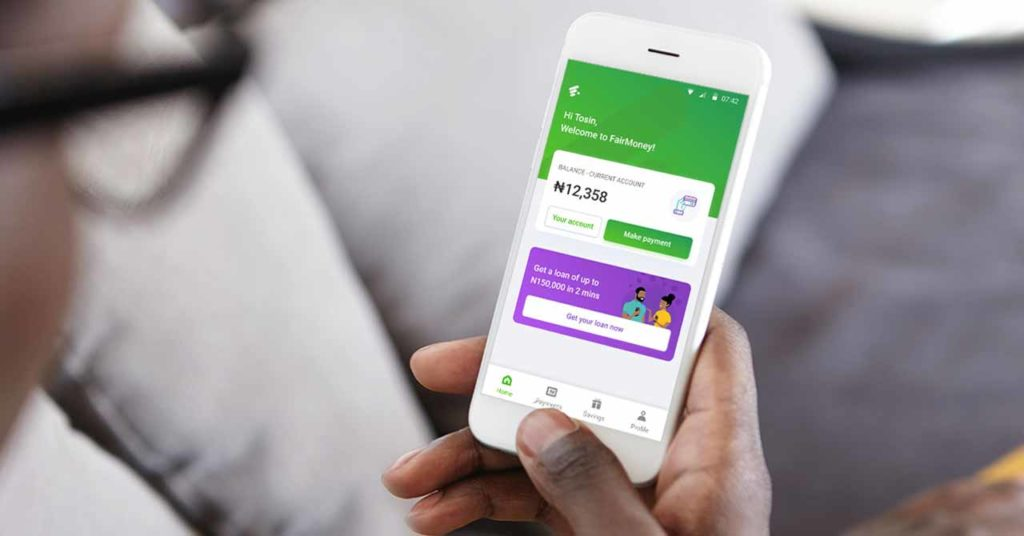

FairMoney: Flexibility and Options

FairMoney is known for its flexibility, especially when it comes to repayment. With interest rates ranging from 20% to 30%, it offers a competitive borrowing option. One standout feature is the ability to extend your loan repayment period by paying an extension fee. This can be a lifesaver if you find yourself short on cash as your due date approaches.

FairMoney also operates like a bank, providing users with a virtual bank account. This means you can conduct various banking transactions, making it a multifaceted financial tool. If you need a larger loan, FairMoney might be the way to go.

However, it’s essential to manage your repayments wisely. While the extension option is convenient, it can also lead to more debt if not handled properly. Always keep track of your finances to avoid falling into a debt cycle.

Final Thoughts on Choosing Loan Apps

Choosing the right loan app in Nigeria can be a daunting task, but it’s crucial for your financial health. Each app has its unique features, benefits, and drawbacks. Always do thorough research before making a decision.

Consider the interest rates, repayment terms, and customer reviews. Look for apps that have a solid reputation and a user-friendly experience. Remember, borrowing should be a solution, not a burden.

In the end, whether you choose Carbon, Palmcredit, L-Credit, or FairMoney, make sure you understand the terms and conditions. Financial literacy is key to managing loans effectively. Stay informed, and you’ll make the best choice for your financial needs.

I have 13 years of experience in customer service at one of Brazil’s largest banks, including 5 years as a general branch manager. I am a specialist in banking products and services with a proven track record in team leadership and business development. I am also a holder of Brazilian certifications CPA-10 and CPA-20.