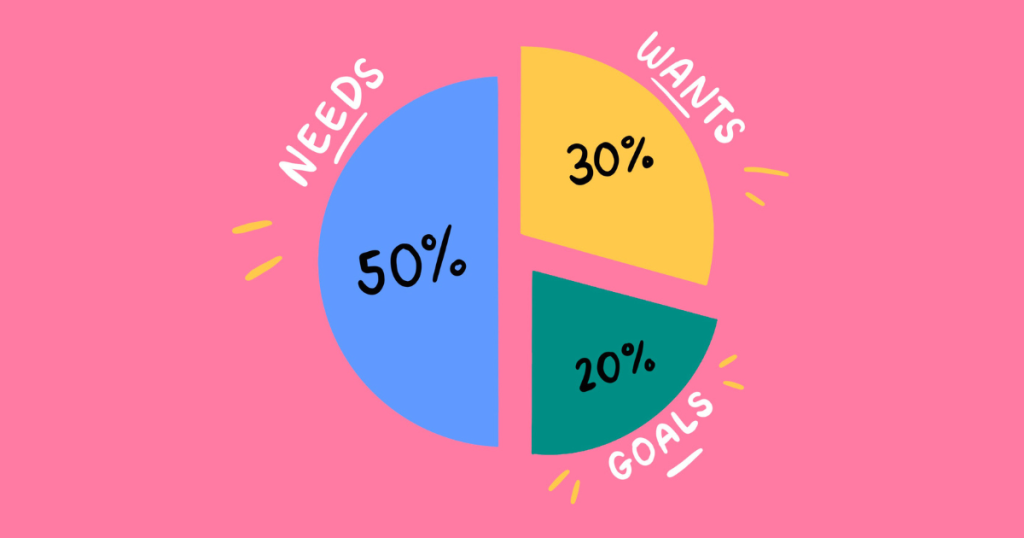

If you’ve ever felt overwhelmed by budgeting, the 50-30-20 budget might just be the solution you need. By breaking your income into three simple categories, this method allows you to easily manage your finances and focus on your goals. Let’s dive into how you can make this budgeting approach work for you!

Understanding the Basics of Budgeting

Budgeting is all about planning your finances. It helps you know where your money goes each month. By creating a budget, you can take control of your spending and save for your future.

Many people find budgeting overwhelming. But it doesn’t have to be! With the right approach, you can make budgeting simple and effective. Understanding your income and expenses is the first step.

What is the 50-30-20 Budget?

The 50-30-20 budget is a straightforward way to manage your income. It divides your after-tax income into three categories:

- 50% for Needs: These are essential expenses you can’t avoid.

- 30% for Wants: These are non-essential items that enhance your life.

- 20% for Savings: This is your future security, including investments and emergency funds.

This method makes budgeting easy by focusing on just three areas. You can quickly see where your money is going and adjust as needed.

The 50% Needs Category

Your needs are the basic expenses required for living. This includes:

- Housing costs (rent or mortgage)

- Utilities (electricity, water, gas)

- Food and groceries

- Transportation (fuel, public transport)

- Debt payments (like loans or credit cards)

It’s crucial to keep your needs within this 50% limit. If you find it hard to fit all your expenses here, consider cutting back on non-essential items or finding ways to increase your income.

The 30% Wants Category

This category is for everything that makes life enjoyable but isn’t necessary. Think about:

- Dining out

- Travel and vacations

- Hobbies and entertainment

- Shopping for clothes or gadgets

It’s important to enjoy life while being responsible with your finances. Allocating 30% to wants allows you to indulge without guilt.

The 20% Savings Category

This category is arguably the most vital. Saving for the future is crucial for financial security. In this 20%, you should focus on:

- Emergency fund

- Retirement savings

- Investments

- Short-term and long-term goals

By prioritizing savings, you build a safety net for unexpected expenses and work towards your financial dreams.

The 50-30-20 Budget: Understanding Your After-Tax Income

Your after-tax income is what you actually take home after taxes and other deductions. Many people make the mistake of budgeting based on their gross income, which can lead to overspending.

To find your after-tax income, look at your pay stub. You can also use online calculators to make this easy. Knowing this number is the foundation of the 50-30-20 budget.

How to Split Your Income into Categories

Once you know your after-tax income, it’s time to divide it into the three categories:

- Calculate 50% for needs.

- Calculate 30% for wants.

- Calculate 20% for savings.

Using a budgeting app can make this process smoother. You can track your spending and adjust your categories as needed. Check out the best budgeting apps of 2025 to find one that suits you.

The 50-30-20 Budget: Handling Debt Payments

Debt can feel like a heavy burden, but with the 50-30-20 budget, you can manage it effectively. Remember, your debt payments fall under the 50% needs category. This includes your minimum payments for loans, credit cards, and any other obligations.

If you find yourself struggling to keep up with payments, it’s crucial to assess your budget. Are you allocating enough to this category? If not, you may need to adjust your spending in the wants category.

For those looking to pay off debt faster, consider using part of your 20% savings category. Here’s how:

- Make your minimum payments from the 50% category.

- Use part of the 20% savings for extra payments.

- Focus on high-interest debts first to save on interest.

This approach not only helps you manage your debt but also accelerates your journey to financial freedom.

Adjusting Your Budget for Extra Payments

Sometimes, you may want to make extra payments towards your debt. This is where flexibility comes into play with the 50-30-20 budget. You can adjust your budget to allocate more money to debt repayment.

Here’s a simple way to do it:

- Assess your current expenses in the needs category.

- Identify if you can reduce spending in the wants category.

- Use those savings to increase your debt payments.

- If possible, use part of your 20% savings for additional payments.

By making these adjustments, you can tackle your debt more aggressively while still maintaining a balanced budget.

Making the 50-30-20 Budget Simple and Consistent

Staying consistent with your budget is key to financial success. The 50-30-20 budget is designed to be simple, so you can easily track your spending. Here are some tips to keep it straightforward:

- Set a specific day each month to review your budget.

- Use budgeting apps to track your spending automatically.

- Keep your categories clear and simple.

- Celebrate small wins to stay motivated.

Consistency is about creating habits. The more regularly you engage with your budget, the easier it becomes. Make it a part of your monthly routine!

Exploring Other Budgeting Methods

While the 50-30-20 budget is effective, it’s not the only option. There are various budgeting methods that might suit your style better. Here are a few to consider:

- 70-20-10 Budget: 70% for needs, 20% for savings, and 10% for wants.

- 80-20 Budget: 80% for needs and wants, 20% for savings.

- Zero-Based Budget: Every naira is assigned a role, so your income minus expenses equals zero.

Each method has its strengths. It’s all about finding what works for you. Experiment with different approaches until you discover the right fit.

Engaging with Your Budgeting Journey

Your budgeting journey should be engaging and rewarding. Here’s how to make the process enjoyable:

- Set clear financial goals, both short-term and long-term.

- Track your progress and celebrate milestones.

- Join a community or forum to share tips and experiences.

- Consider using visuals like charts and graphs to see your progress.

Engagement makes budgeting less of a chore and more of a journey towards your financial goals. Remember, it’s all about progress, not perfection.

Are You Ready to Apply the 50-30-20 Budget?

Budgeting doesn’t have to be complicated. The 50-30-20 budget is a simple and effective way to manage your finances while ensuring you’re prepared for the future. As you embark on this budgeting journey, remember to stay flexible and adjust as needed.

Next steps include:

- Assess your current financial situation.

- Calculate your after-tax income.

- Start allocating your income using the 50-30-20 method.

- Explore other budgeting methods if needed.

For more resources, check out our guide on borrowing wisely and discover small business ideas to boost your income. Remember, every small step counts towards a brighter financial future!

I have 13 years of experience in customer service at one of Brazil’s largest banks, including 5 years as a general branch manager. I am a specialist in banking products and services with a proven track record in team leadership and business development. I am also a holder of Brazilian certifications CPA-10 and CPA-20.